Founded in 2015, Akash Network is an open-source cloud computing server that enables faster, greater efficiency, and lower cost application deployments for high-growth industries which includes DeFi, decentralized organizations and applications, and machine learning/AI.

Context

According to research, the global cloud computing market size is expected to reach USD 1,251.09 billion by 2028, registering a CAGR of 19.1% over the forecast period. Although centralized tech giants like Google, Amazon and Microsoft dominate the world of cloud computing today — the future may have an alternate path forward.

The main driver for the adoption of cloud computing is the idea of flexibility and cost benefits. But in reality, the products offered by cloud providers are overpriced, complicated, and lock clients into ecosystems that limit their ability to innovate, compete, and have sovereignty over their infrastructure needs. As a result, enterprises are prevented from adopting agile multi-cloud solutions for their business needs. Furthermore, analysts estimate that as many as 85% of servers in practice have underutilized capacity, which is extremely costly and wasteful.

Decentralized cloud offerings could open up the likelihood of adopting and executing cloud tools and applications from different vendors in a modular fashion, exposing them to the best available toolkits to run their cloud-based programs on. This would be a huge development from what’s available now, whereby compatibility between the big cloud players is finite and support for third-party cloud add-ons is almost zero.

Decentralized environments could offer additional layers of security and redundancy protection with backup service providers. Furthermore, service providers on a decentralized platform could possibly leverage on each other’s services shared across one network.

Decentralized cloud computing is growingly popular because of the incredible work done by the pioneers of these technologies. It has created an environment where a lot of inexpensive, latent capacity is available from data centers and cloud computing providers, allowing data to be stored and accessed at insane speeds for better collaboration, transparency, efficiency and innovation. By utilizing peer-to-peer concepts in a highly distributed network at an enormous scale, it has helped to solve the various challenges of the highly distributed environment.

Introduction

Akash is a secure, transparent, and decentralized cloud computing marketplace allowing those who require computing resources to connect with those who have the computing capacity to lease.

As compared to cloud storage, cloud computing is used to work on and complete specific projects and not simply to save and keep data. Cloud computing has links to cloud storage because data has to be transferred to the cloud storage before cloud computing systems can be used. Once data is directed to the cloud storage, anyone can process it into useful material to complete projects. The main difference between cloud computing and cloud storage is as follows:

- Cloud computing requires higher processing power than cloud storage.

- Cloud storage requires more storage space than cloud computing.

- Cloud computing is mainly targeted at businesses while cloud storage targets both professional and personal sources.

- Cloud storage is simply for the storage of data while cloud computing enables remote working and transformation of data (e.g. coding an application remotely).

Within Akash DeCloud, there are two main components involved: Akash Network and the Akash Platform. Akash Network is a decentralized, on-chain marketplace meant for the leasing of computing resources. It is a Tendermint based blockchain application built with Cosmos SDK. On the other hand, the Akash Platform is an off-chain deployment platform meant for hosting and managing workloads. It is also a set of cloud management services that leverage Kubernetes to run workloads.

Illustration of on-chain and off-chain interactions amongst various participants in the Akash network:

Akash provides a peer-to-peer protocol for distributing workloads and deployment configuration. Workloads in Akash are also called Docker containers, where it allows for highly-isolated and configurable execution environments, which are already part of many cloud-based deployments today.

Product Analysis

Akash. Network currently has over 400 deployments active, a growth of 2x from 200 just a month ago.

Network Participants

- Validators: Validators perform the role of validating and relaying transactions, proposing, verifying and finalizing blocks. The set of validators will initially be limited to 64 as they will be required to maintain a high standard of automated signing infrastructure. They charge delegators a commission fee in AKT.

- Delegators: Delegators hold AKT and use a portion or all of these AKT tokens to secure the Akash chain. In return, they earn a proportion of the transaction fee as well as block rewards.

- Providers: Providers offer computing cycles (usually unused) on the Akash network and earn a fee for such contributions. They are required to stake AKT as collateral, in proportion to the hourly income earned; therefore, every provider is a delegator and/or a validator.

- Tenants: Tenants lease computing cycles offered by providers for a market-driven price set using a reverse auction process (explained in this article).

Marketplace

Tenants lease infrastructure from providers via a decentralized exchange known as the marketplace. Within the marketplace, there is a public order book and a matching algorithm.

Tenants have to place deployment orders, which requires them to specify their service needs and the maximum amount they are willing to pay for a fixed number of computing units (as measured by memory, cpu, storage, and bandwidth) for a specified amount of time.

Then, data centers will place fulfilment orders to bid on deployment orders. Fulfilment orders declare the prices that providers will provide the resources for. Deployment orders will be open for a tenant-defined length of time and while open, providers may post fulfilment orders to bid on it.

As long as the minimum specifications of the deployment order are met, a fulfilment order can be matched with that deployment order. Given a deployment order and a set of eligible fulfilment orders, the fulfilment order offering the lowest price will be matched with the deployment order. If multiple fulfilment orders are eligible for a match and offer the same price, the fulfilment order placed first will be given priority.

Businesses and individual consumers will need to be aware of and protect the way they display their use of compute power. To safeguard themselves from competitor data mining and other attack vectors, a homomorphic encryption layer is added.

Once there is a match between the deployment and fulfilment order, a lease containing references to both the deployment and fulfilment orders will be formed. It serves as the binding agent in fulfilling a deployment.

The diagram below illustrates how procurement occurs in the marketplace:

- Tenants define their specifications. Desired lifetime of resources is expressed via collateral requirements.

- Orders are generated based on the tenant's definition.

- Data Centers bid on open orders.

- The bid with lowest price gets matched with order to create a lease.

- Once a lease is reached, workloads and topology are delivered to the datacenter.

- Datacenter deploys workloads and allows connectivity as specified by the tenant.

- If a datacenter fails to maintain a lease, collateral is transferred to the tenant and a new order is created for the desired resources.

- A tenant can close any active deployment at any time.

Tokenomics

$AKT Token and Use Cases

$AKT is the native utility token of the Akash Network. Its primary function is to govern and secure the blockchain, and provide a default mechanism to store and exchange value. $AKT acts as the reserve currency in Akash’s multi-currency and multi-chain ecosystem, while protecting the economic security of the platform’s public blockchain by means of staking.

Besides the native $AKT that can be utilized in the settlement of transactions in the marketplace, leases can also be settled with any other whitelisted tokens such as $BTC. However, transaction fees and block rewards are denominated in $AKT. In order to protect providers and tenants from price volatility of $AKT caused by its low liquidity, an agreement can be made to lock in an exchange rate between $AKT and the settlement currency.

The uses of $AKT include:

- Governance: Vote on network upgrades, and allocation of the Decentralized Cloud Foundation’s funds and resources.

- Incentivization: Incentivize providers and stakers.

- Value Exchange: Provides a default mechanism to store and exchange value, and acts as a reserve currency in Cosmos' multi-currency and multi-chain ecosystem.

- Take Income: As soon as the network attains more significant gross merchandise value (GMV), rewards will encompass inflationary rewards and incorporate a share of the total network spend (Take Income) users pay.

Token Supply

Genesis Supply:

The token unlocking schedule is fair and ensures a gradual release of genesis tokens (100,000,000) over the course of 3 years.

Total Supply:

Max Total Supply: 388,539,00

Token Inflation

The rate of inflation will be dependent on the number of short-term and long-term miners that are working in the system. Depending on this, the initial inflation will be anywhere between 50% APR (if all commit short-term) and 100% APR (if all commit long-term). The rate of inflation will decay exponentially daily, halving some time between 2 years (if all are long-term) and 4 years (if all are short-term).

Value

The key driving force for the earning potential of $AKT is from their Gross Merchandise Value (GMV), essentially the accumulated value of all completed transactions in the marketplace in a given period of time. It is crucial to note that the features that make $AKT intrinsically valuable are not theoretical or speculative, but rooted in simple economics.

Akash’s proposed take rate is 20% of their GMV and all of the proceeds will go back to all AKT token holders and not Akash.

Motivation

Essentially, $AKT performs three main functions: Resolve, Reward, and Reserve.

- Resolve: The network relies on a blockchain whereby a set of validators vote on proposals. The voting power on each proposal is weighed by the total tokens staked and the tokens bonded to them (stakers can delegate voting power to validators).

- Reward: Users of Akash stake $AKT to fund operating and capital spendings. The income earned by stakers is proportional to the number of tokens staked, the length of lockup time, and the overall tokens staked in the system.

- Lockup period ranges from a month to a year.

- The flexibility in lockup period encourages stakers who stake for shorter periods (bear markets).

3. Reserve: $AKT acts as the reserve currency of the ecosystem. Akash offers a novel settlement option to lock in an exchange rate between $AKT and the settlement currency. This keeps providers and tenants protected from the price volatility of $AKT expected to result from its low liquidity.

By offering exponential cost savings for tenants, Akash network aims to provide a value proposition via early adoption. The efficiency of a serverless infrastructure also serves as an extra value proposition for tenants and providers. These value propositions are extremely compelling, particularly for data and compute intensive applications like machine learning.

Planned Roadmap

As of now, they have fulfilled the following milestones on time:

✅ Akash Network Mainnet 1

✅ Akash MAINNET 2 Launch

✅ Akash Network Develops Critical IBC Relayer

✅ Akash Network Integrates with Equinix Metal

✅ AKT Token On Gate.io

✅ Pair with Cosmos Native Coin (ATOM)

✅ Launch Developer Grant Program

✅ Supported on a second decentralized exchange, Emeris.

Upon further research, there does not seem to be much coming up for the rest of 2021. However, the Switcheo Research team will constantly keep an eye on updates from the network.

Fundamental Analysis

Macro Analysis

According to research, the global cloud computing industry is expected to grow from $371.4 billion in 2020 to $832.1 billion by 2025, at a CAGR of 17.5%.

With the centralized cloud computing market being highly oligopolized, innovation, choice, and flexibility are stifled, and current services come at a high recurring cost with lock-in agreements. Cloud costs have a compounding annual growth rate of 43.6% through 2022, and with 25% of machine learning/AI companies’ revenues spent on cloud resources, managing costs is critical to growth.

Thus, more and more people are shifting to decentralized cloud computing networks for greater access, flexibility, efficiency, and security. In time to come, the decentralized cloud computing sector will definitely grow in value and market size over time.

IBC Integration

In early March 2021, Akash officially launched the Akash Mainnet 2. They are also one of the first networks in the world to integrate with IBC and IBC Relayer in their Mainnet 2, running on Cosmos SDK 0.4.0.

The integration with IBC within the Cosmos ecosystem will enable more projects to communicate and exchange value across the Cosmos Hub, and take part in Akash's decentralized marketplace. The token, $AKT, is currently tradable on the Osmosis Zone as well.

With IBC, Akash will bring down the barriers to adoption by enabling other currencies to access their cloud marketplace and pay for cloud computing. This will ultimately help to bring Akash towards becoming a truly decentralized and interoperable cloud.

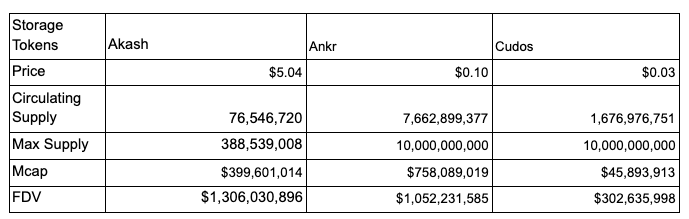

Competitor Analysis

The key competitors of Akash include Cudos and Ankr, both of which are built on the Cosmos SDK.

Cudos serves as an interoperable blockchain network designed to provide computing power for building dapps and deploying smart contracts and non-fungible tokens. Although the platform is built on the Cosmos ecosystem, the team is planning to deliver cloud computing power beyond the Cosmos Hub Zone.

Ankr strives to build a resource efficient blockchain framework that truly enables Distributed Cloud Computing (DCC) and provides user-friendly infrastucture for business applications. Ankr is the first to leverage both blockchain and trusted hardware, and currently offers developing and staking resources for more than 40 blockchain protocols. A few of the supported platforms include Cosmos, Polkadot, Bitcoin, Compound, and Elrond.

Comparing Market Stats

Akash vs. AWS

When it comes to whether Akash will replace the big 3 in centralized cloud computing in time to come, there have been mixed opinions. Today, we will compare Akash with AWS, a frontrunner to other cloud computing platforms.

We look at a simple price comparison between Akash and the cloud giants:

We observe that for the same type of service, Akash offers a much lower price than the other cloud giants like AWS. Furthermore, Akash Supercloud is a faster, more secure, and lower cost alternative to cloud service providers.

The reason why AWS can only take so much is because they are a centralized service and thus have a limited number of networks, modules and tech to be able to give them the speed like Akash. In comparison, Akash Supercloud enables organizations to reach out to the 85% of server capacity that are currently underutilized at 8.4 million data centers across the world, and on individual servers.

Opportunity

Since the rise of the global pandemic, cloud computing services have become increasingly expensive and cost-prohibitive for startups, academic institutions, researchers, and clinicians who need to accelerate critical research to fight COVID-19, and develop life-saving treatments.

With more of our work and play moving online couplied with the rapid rise in costs for cloud computing services, this serves as a huge opportunity for Akash to tap on their competitive advantage to reach out to the market and provide broader market use cases.

Target Audience

The target audience of Akash is essentially all high-growth companies with data intensive workloads. The team aims to support lower growth businesses with a diverse set of workloads by expanding their market use cases.

The company’s main market is growth stage machine learning organizations, including artificial intelligence and deep learning companies. Ultimately, if an application runs on existing cloud service providers like AWS, Google Cloud, or Azure, it can run on Akash.

Community

Telegram - 17,795 members

Twitter - 43,900 followers

Discord - 6,303 members

We can see that the Akash network community is relatively strong. Currently, the network has got plenty of user generated content (UGC) from the community. This ranges from explanatory videos to comparison videos between Akash and AWS. This shows how the active community is willing to commit their time to provide their opinions and share their analysis. This ultimately would help them in enhancing their brand recognition.

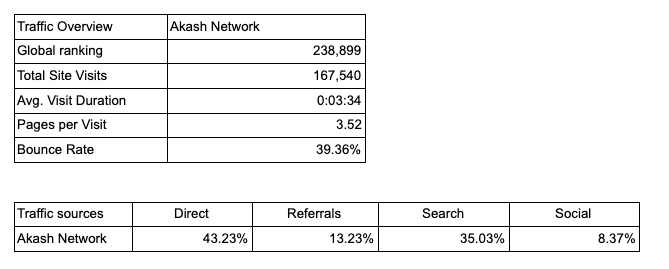

Traffic

Team

Akash was founded by Greg Osuri and Adam Bozanich. Both of them are globally recognized open source developers and are among the top 20 programmers worldwide for authoring open-source libraries adopted by organizations such as Ubuntu, HashiCorp, and Kubernetes. Both lead a team of renowned open source and blockchain developers, and seasoned experts from leading technology platform companies.

Greg Osuri, CEO:

Before Akash, Greg built information technology (IT) infrastructure at IBM early in his career and founded AngelHack, the world’s largest hackathon organization with over 150,000 developers across 50 cities worldwide. He is also the author of UI Progress and Amazon RDS Cookbook -- widely used DevOps toolkits with more than 25 million downloads.

Greg has contributed to the launch of multiple developer companies which includes Firebase (acquired by Google) and played a significant role in the passing of California’s first Blockchain law, providing the first expert-witness testimony at the Senate.

Adam Bozanich, CTO:

Before Akash, Adam led software development at WeWork, Symantec, One King’s Lane, and Marketron. Prior to that, he was an engineer and developer for music monetization platform Topspin, which was taken over by Apple in 2014 following an initial acquisition by Beats.

Adam holds a U.S. patent for the invention of network protocol fuzzing, a security analysis methodology that dynamically tests a system’s resilience to protocol abuse.

Boz Menzalji, COO:

As COO, Boz contributed significantly to the successful acceleration of Akash Network. A serial entrepreneur and business development leader, Boz has observed two acquisitions and previously worked as GM at Refereum, a blockchain-based gaming rewards and marketing platform. Prior to Refereum, he led business development for multiple SaaS startups.

Cheng Wang, CFO:

Previously, Cheng served as the CFO for WRKSHP, a high growth San Francisco gaming startup and Refereum, a premier blockchain startup. His financial expertise includes both equity and debt valuation, derivative instruments, and portfolio management.

Partners

Akash secured partnerships with top leaders and global organizations across technology and venture capital to materialize the vision of The Unstoppable Cloud.

The key partners of Akash include:

Technical Analysis

$AKT has likely bottomed out at the 0.382 fib retracement (log scale) around $1.95. Using fib extensions to the 0.618, a common profit taking area, the profit taking price is around $13.60.

That presents a risk reward ratio of 6 if the entry price was around $3.60.

The current RSI levels are approaching overbought levels, hence waiting for a pullback to around $4 before entering might present a better buying opportunity.

Risks

Being a decentralized network in nature, it is almost impossible to control the legal or ethical aspects of the work offered. Hence, users could make use of the computing power to conduct morally dubious or illegal actions. While the team does not accept such actions, any form of strike against these actions would compromise the openness of the network and spoil its purpose. As the team is only in charge of creating the tool, they cannot decide how end-users utilize that tool.

Conclusion

With the growing popularity and demand for cloud computing, Akash network is in a prime position to benefit from this massive growth by providing cheaper computing power by leveraging on underutilised data centers.

With IBC, Akash network will be able to adopt more cosmos-based cryptocurrencies to access their cloud computing marketplace, lowering the barrier to adoption and increasing the utility of the Akash network, turning it into a more interoperable cloud computing network.