Mirror is a dapp on Terra network that allows anyone to issue overcollateralized synthetic assets, and trade them. Think of Mirror as Robinhood but with the benefits of a fast and cheap blockchain, without permissions and KYC.

Introduction

With the rise of DeFi and crypto, it has created new opportunities to revolutionize how assets are issued, managed, and transacted.

Assets on the blockchain can be easily broken down into smaller units, making investments that are historically illiquid become fairer and more efficient, from paintings, to media, real-estate, collectibles, and even shares. Shares, being one of the biggest asset classes in the world, already have trials being done to deliver them on the blockchain but it may take a long time due to regulations and bureaucracy.

In the meantime, centralized crypto platforms from Binance, Bittrex, and FTX have launched their own tokenized stocks.

“Stock tokens demonstrate how we can democratize value transfer more seamlessly, reduce friction and costs to accessibility, without compromising on compliance or security. Through connecting traditional and crypto markets, we are building another technological bridge for a more inclusive financial future.” - Changpeng Zhao

However, on 16 July, after facing pressures from regulators around the world, Binance will cease their tokenized stock trading service, opening up an opportunity for synthetic stocks on decentralized blockchains to gain popularity.

The Opportunity

What are synthetics and what problems do they solve?

At its crux, synthetics are divisible and fungible assets that track the price of real world assets. To ensure the price remains soft-pegged to the price it is mirroring, they are backed by underlying collateral, an oracle and a liquidation engine.

Synthetics can be seen as alternatives to traditional stocks and equities, possessing core qualities that surmount the limitations of TradFi. Below, we dive into some of the key reasons why we believe Mirror protocol brings greater value to the evolving financial ecosystem.

Accessibility

The total market capitalization of all stocks in the world is approximately $89.5 trillion as of 2020, with the US taking up $36.3 trillion dollars, making it an attractive asset class globally.

As of 2017, about 1.7 trillion, or 20% of the global population is still unbanked and have no access to this market due to the banking requirements needed to trade equities on exchanges and brokerages.

Mirror solves this by opening up access to these assets, allowing 1.7 trillion, and more, to directly bypass banks and brokerages to gain access to US equities (and other asset classes) with just their phone and internet in a permissionless manner.

However this also opens up the possibility of securities fraud from insider trading where an insider of a company listed on the Mirror protocol can anonymously place a trade on mirror with the benefits of having insider information not privy to the public, which is a type of fraud in the USA as it allows a few to ‘game’ the system.

Availability

Equities are traditionally only traded during market opening hours, at least for the public. Institutions and certain brokerages however can conduct trades even when the market is closed or during pre-markets. This means the public are unable act on new information immediately if the market is closed.

Mirror allows trading of mirrored assets 24/7, even when the market is closed on the weekend, allowing anyone to buy and sell mAssets at any point of time.

This also improves convenience as anyone can trade equities when they are free if their free time is during closing hours.

However, users cannot short assets that they do not have when the market is closed as the protocol does not allow for assets to be minted and sold (aka shorting). Users can however sell the assets if they already own them.

Information Arbitrage

Sometimes, new information appears when the market is closed. In these instances, financial institutions let alone the public are unable to make any trades. Mirror, however, is still available for individuals to trade on, presenting a huge advantage and opportunity to users of the platform.

For example, if a negative piece of news on Tesla was released over the weekend and you think the price of Tesla is going to drop, you can sell off your Tesla shares before the pre-market opens with Mirror.

Another example is: if during market close, the central bank announces that they are about to implement something that can be seen as bearish - like starting to taper bond purchases, and the NASDAQ futures and S&P futures is visibly crashing by 5% - 10% but because the pre-market is not open - you can sell your assets beforehand as prices on Mirror protocol are unlikely to react to speculative news and mirrors the stock market prices more closely.

Fractional Shares

Mirror assets can be divided into many decimal points, allowing greater freedom for individuals in trading their assets. There is no longer a need to purchase or sell one full share as they can now be traded fractionally instead. People all over the world are able to invest in Tesla even when if goes up to $3000 in the future, creating greater accessibility to popular assets as well.

While fractional ownership for shares is becoming increasingly common in brokerages, it comes with increased operational overhead. This does not exist with tokenized shares.

Liquidity Incentive

Mirror protocol enables liquidity provision with existing assets to earn reward tokens in $MIR while still keeping your assets, which prevents your assets from sitting idle. However this is subjected to impermanence loss.

Instant and final settlement

All transactions are also final, unlike traditional brokerages where it takes 2-3 business days for the transaction to finalize. This allows investors on Mirror to transfer funds out immediately, which prevents exposing investors and the industry to unnecessary risk. Robinhood agrees that T+2 needs to go as well.

Cheaper Fees

Traditional brokerages still cost $10 to enter and exit a position. On Mirror protocol it costs from $0.10 to $1.50, almost 10x cheaper.

Unstoppability

The mirror protocol has been decentralized from Day 1, with the on-chain treasury and code changes governed by holders of the $MIR token (which Terraform Labs holds none of). There are also no admin keys or special access privileges granted, preventing rug pullings from possible.

This means that a situation like the Robinhood-Gamestop saga cannot happen - where centralized brokerages can prevent someone from buying a stock- or instances like the COVID crash where many brokerages halted the ability to go short on industries that were directly affected by the pandemic, such as airlines, resorts, casinos, travel, and hospitality.

The website is also hosted on Github, and anyone is able to clone and host it.

Diversification within crypto

Mirror protocol allows crypto users to diversify their portfolio away from crypto without exiting the crypto ecosystem due to the growing number of shares and ETFs on Mirror. This is important for users to remain in crypto during a bear market as they can trade non-crypto related assets.

The Macro

The cryptocurrency wave

From art to music, buildings and even electricity, everything on earth is being tokenized onto the blockchain due to the benefits listed above.

With the surging popularity of crypto and the value it brings to the financial landscape in a way TradFi is limited by, there is more demand and investments pouring in to build the next financial system on the blockchain.

Mirror, with their strong product and team, is in an ideal position to ride that wave up and create products that are in high demand as shown from their growth.

The young investor wave

With the increased popularity of investing due to wall street bets, increased awareness of money printing, subsidies and handouts given by the governments all over the world, alongside rising inflation expectations, many young adults are learning about how to invest fast.

Robinhood gained 3 million users in Q4 of 2020 alone.

Mirror is a platform that could potentially disrupt Robinhood, especially after the Robinhood Saga that gave rise to Mirror’s popularity and saw a users shifting over to the platform. Hence, there is significant potential for user growth on Mirror protocol.

Messari wrote an article about this as well.

Tokenomics

The Mirror token ($MIR) is the governance token minted by the protocol and distributed as a reward to liquidity providers (LP Tokens). $MIR holders earn the burning fees whenever a CDP is withdrawn or closed.

The utility of the token can be seen in how $MIR stakers can vote on governance polls. To create a governance poll, 100 $MIR tokens are required which are then burnt (probably to $MIR stakers) if the proposal fails, and refunded if the proposal succeeds.

Supply

Mirror is a fixed supply asset with only 370,575,000 MIR tokens to be distributed over 4 years. Beyond that, there will be no more new MIR tokens introduced to the supply.

Emission rate

In 2021 - Year 1 - Mirror Protocol is set to print a total of 128.1m (183m - 54.9m) $MIR tokens, or 350,728 $MIR tokens in a day assuming emissions follow a linear inflation.

In 2022 - Year 2 - it will print an additional 73.2 million $MIR tokens.

Demand to sustain price level

At $MIR's current price of around $3.00, the demand required to sustain the price of $MIR a day is about $1m a day assuming that everyone who received $MIR tokens chooses to sell them. The daily demand / marketcap is 0.44% which is relatively high.

Assuming price stays constant, next year, the annual inflation drops to 40% or around 200k $MIR tokens a day. Hence the daily demand required to sustain the price will drop to around $600k per day, and the new marketcap will be around 750m, with the daily demand/marketcap dropping to around 0.08%.

Competitors and Valuation

The main direct competitors of Mirror are $SNX and $LUNA.

There are other direct and indirect competitors such as Deus Finance on BSC, the upcoming Solrise on Solana, and FTX's synthetic stocks, however there is insufficient data on those protocols to provide an accurate valuation.

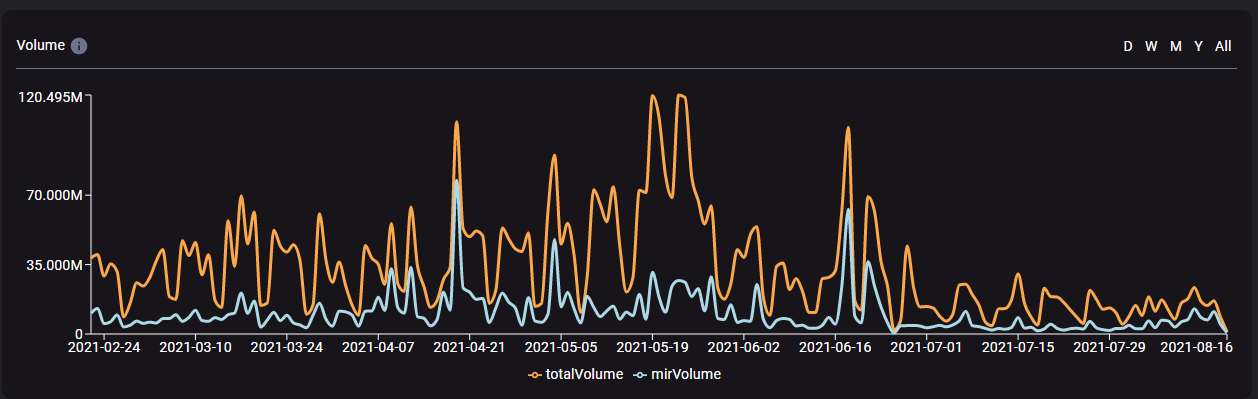

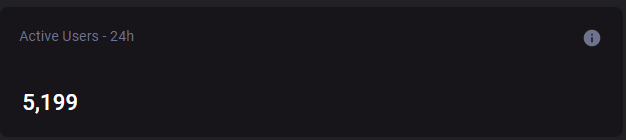

In terms of protocol volume, fees, and PS ratio, based on the statistics, Mirror protocol seems to be the most fairly priced at the moment. One thing to note is that the amount of active users Mirror protocol has is significantly higher than other protocols.

SNX

Synthetix is similar to Mirror and is considered one of Mirror's main competitors. It is also a decentralized finance (DeFi) protocol that provides on-chain exposure to a wide variety of crypto and non-crypto assets. However the protocol is based on the Ethereum (ETH) blockchain and is subjected to high gas fees as well as a high collateralization ratio of 500% compared to Mirror's 150%, which could be an important factor for the cause of lower volumes and transactions.

Mirror's fees generated when compared to Synthetix also seems to be higher across time. The number of trades on both Synthetix, which is also similar to Mirror. In terms of fees generated, Synthetix is generating about 500k USD a week, compared to Mirror which is generating an average of about 40k fees a day (or about 280k a week) if we only take the past month into consideration.

In terms of users, Synthetix might not be able to accurately capture this number, and has repeatedly reported a low figure, so the monthly visits was used instead. However both visits and users are still low when compared to Mirror's.

The market cap of $SNX as of 16th August 2021 is about 7x more than $MIR.

Analytics: Stats (synthetix.io)

LINA

Linear is a decentralized delta-one asset protocol capable of instantly creating synthetic assets with unlimited liquidity. The project opens traditional assets like commodities, forex, market indices and other thematic sectors to cryptocurrency users by supporting the creation of “Liquids” — Linear’s synthetic asset tokens.

Dashboard: Linear | Dashboard

FTT

FTT is a popular centralized crypto exchange that has synthetic equity pairs, competing with $MIR platform for synthetic equities.

Product

After using various DeFi products since the start of January, Mirror stands out as an easy to use DeFi product in terms of UIUX.

Wallet

The Luna ecosystem has its own Terra wallet. It is easy to use and allows one to create and switch between multiple wallets with different seed phrases easily, for added security in a convenient manner.

The password needs to be keyed in before every transaction as a safety precaution, but there is a checkbox to save it and auto fill it for one hour.

There is also the Terra Station desktop app that allows one to swap $MIR and $UST, as well as other assets.

They also have a native wallet app which has not been tested by the Switcheo Research team. It recently supports direct onramp with credit card usage.

Platform

The Mirror platform looks clean and is easy to use. It also supports the bridge from ETH, BSC, and Harmony, and will likely support more in the future including Solana via the wormholebridge, allowing for greater interoperability.

The dashboard:

Governance

Mirror has had a functioning governance DAO from the start, and has about 12% APR for staking rewards as well. 100 $MIR tokens are needed to create a voting proposal, and to vote on proposals, $MIR tokens are needed to be staked first in order to vote. During the voting process, the staked $MIR tokens cannot be unstaked.

Ecosystem

Terra

$MIR is part of the Terra ($LUNA) ecosystem that uses $UST as their algorithmic stablecoin. Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offers fast and affordable settlements.

What makes Terra impressive is the real world adoption from Terra Alliance. Terra Alliance is a group comprising 15 e-commerce and payment companies from Korea and Southeast Asia. The vision is to help drive adoption for Terra stablecoins and the Terra ecosystem.

Audit: CertiK Security Leaderboard - Terra

TerraUSD

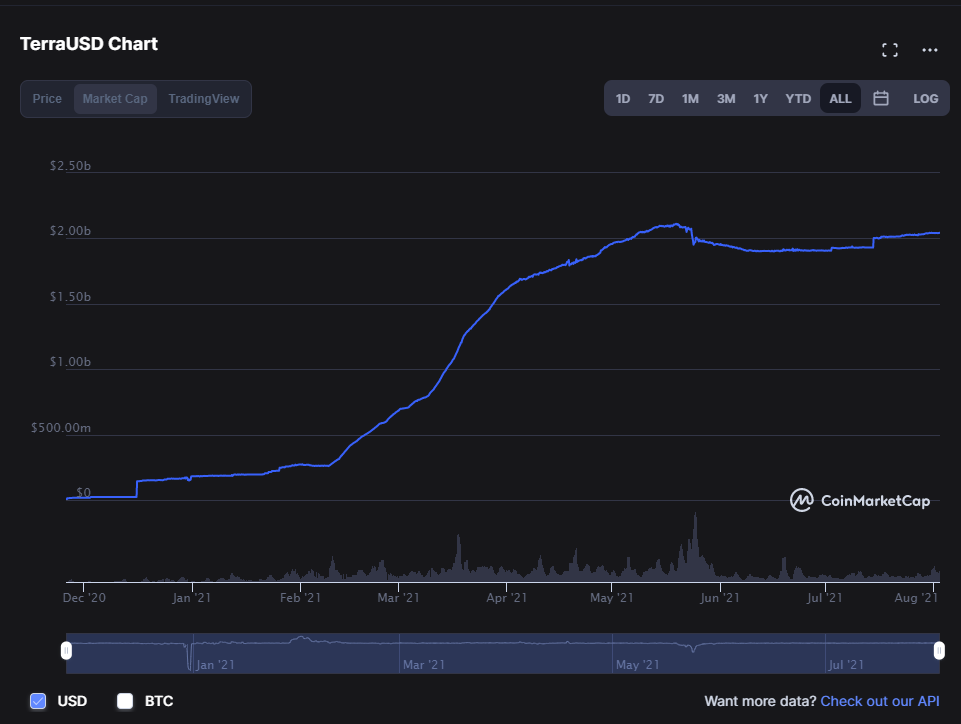

The demand and therefore market cap for UST has been steadily increasing which shows strong user growth.

Since the start of the year, in less than 3 months, it has grown from a $181m market cap to $2b, an increase of about 10x. They now rank top 50 on Coinmarketcap.

TerraUSD price today, UST live marketcap, chart, and info | CoinMarketCap

This has caused the price of $LUNA to moon as well increasing by 2500% in Q1 of 2021 alone and is now about 1700% year to date.

Anchor

Anchor is a savings protocol on the Terra blockchain that offers yield powered by block rewards of major Proof-of-Stake blockchains. Anchor offers a principal-protected stablecoin savings product that pays depositors a stable interest rate.

It achieves this by stabilizing the deposit interest rate with block rewards accruing to assets that are used to borrow stablecoins. Anchor will thus offer DeFi’s benchmark interest rate, determined by the yield of the PoS blockchains with highest demand.

Anchor currently offers a UST savings rate of 20% as a stable rate, increasing the demand for UST.

Anchor has a market cap of $220,614,260 and a fully diluted valuation of $4,408,126,839 with a volume to market cap of 0.02871.

White paper: anchor-v1.1.pdf (anchorprotocol.com)

Overview

Below is an overview of the existing products in the Terra ecosystem and how they interconnect with each other.

Web Analytics

MIR

Mirror protocol has strong and constantly growing organic search traffic of 24.3k per month in July, up 30% from June.

Synthetix

Synthetix Mintr has 6.2k in search traffic, yet that is the burning and staking platform and not the actual platform.

Their exchange platform, Kwenta, has a search traffic of 636.

Linear

Linear has quite a strong traffic, with 6.8k traffic in March, down 27% from the previous month, but the traffic seems to be stagnating or not growing whereas mirror is making new all time highs.

Risks

Smart Contract Risks

As with every smart contract, there are technical risks which can be exploited leading to loss of funds.

Mirror protocol has been audited by CyberUnit.

Audit link: https://docsend.com/view/p4es2dgvwadamgqg

UST Risks

As the Mirror ecosystem primarily uses $UST as its native currency, in the event of a loss in confidence of $UST, it could result in a bank run where everyone sells $UST and $LUNA causing a death spiral that $UST may not recover from.

In May 2021, the crash of bitcoin caused the price of $LUNA to drop below the marketcap of $UST, which caused a panic as the community believed that $UST was undercollateralized as $LUNA is the main collateral for $UST.

However the intrinsic value of $UST is not entirely from the price of $LUNA, it is also derived by real-world demand from the Terra Alliance as well. As long as there is real-world demand for $UST, $UST can recover its peg.

Regulatory

SEC Chairman Gary Gensler is issuing warnings about synthetic stocks, and Mirror protocol’s mAssets may be considered securities. Let’s explore what other experts have commented.

Joseph Saluzzi, the co-head of equity trading at Themis Trading has said that these synthetic products are not regulated and not traded on a national securities exchange hence the SEC would take issue with them. The mission of the SEC is to protect investors and maintain fair, orderly and efficient markets, hence they are likely to step in to protect investors interests. However it is important to note that SEC regulations are largely applicable to US citizens only.

TFL is based in South Korea and Singapore and hence is out of the jurisdiction from the SEC. Yet, the close ties that SK and SG have with the USA might mean a regulatory collaboration is possible.

Additionally, South Korea is creating stricter regulations on crypto exchanges and this regulation could extend to ceasing Terraform Labs' operations. Although mirror is a decentralized protocol, its main developers are from Terraform Labs (TFL) which could pose a centralization risk in the form of ceasing development updates if Terraform Labs are banned from working on the Mirror protocol.

That may potentially kill or halt the development of the Mirror protocol as it is still too young for it to be completely decentralized without TFL’s leadership and developers. But if that happens, TFL could move to Singapore where the jurisdiction are more crypto-friendly. In the future, TFL has mentioned that it is looking to disband to remove the centralization risk of Terra.

TFL have also been using KRT (Korean Won Terra) for quite a while already and have the support of Terra Alliance and no government actions has been taken against them so far.

In a recent interview on 30th July 2021, Do Kwon noted that while he agrees that the regulatory landscape is evolving, there is not much they can do to shut down the protocols that have been built.

“We don’t really operate these platforms to profit. What we could be held liable for is really expressing the freedom of speech by writing codes.”. - Do Kwon

Do Kwon has also said that Terraform Labs has not been approached by regulators in the US or elsewhere about mirrored equities. Technologically, it would also be difficult to shut down the underlying open-source software code that constitutes the blockchain since it is used by a global user base with many anonymous players. He states that it would be a “sisyphean task” to shut down crypto and DeFi as long as there are firm believers in his vision.

Mirror protocol may however still need to figure out how to prevent incidents that go against investors’ interests like securities fraud, insider trading, pump dumps, etc. Otherwise, people would abuse it to circumvent securities law and the SEC may try to take legitimate action.

“If we want this ecosystem to grow, we need to recognize we need to operate within the rules society sets.” This was stated by Billionaire crypto investor Mike Novogratz.

Core Team

Do Kwon is a graduate from Stanford in computer science and works at Microsoft as an NLP Engineer. He also made it to the Forbes 30 under 30 and later founded a startup called Any-Fi which does P2P telecommunication solutions.

Daniel Shin founded extremely successful companies like TMON (Alibaba of South Korea) and CHAI (Softbank-backed).

Nicholas Platias is the Head of Research at Terra.

Roadmap:

After the successful launch of Mirror v2, there are now plans to do a v3.

The Terra/Luna/Mirror community, led by Terraform Labs’ Do Kwon has ambitiously established plans for further innovation in v3. They have three key benchmarks set:

- Powering more front-end user interfaces:

For instance, one recent project is planning a WallStreetBets-branded UI linked to the Mirror protocol.

WSB succeeded in attracting younger and more aggressive equity traders to platforms like Robinhood, by making trading cheaper and easier.

Thus, Mirror is aiming to create the DeFi equivalent.

2. Making leverage and income generation possible:

Leverage and leveraged yield-farming in DeFi is much more challenging when compared to that in real world securities.

Therefore, Mirror is actively forming partnerships with different protocols within the Terra ecosystem to address this issue.

For instance, Mars Protocol will allow leveraged yield farming of mAssets and Levana Finance will enable leverage to the trading of mAssets.

3. Composability (Mirror’s final goal)

mAssets are composable tokens that can easily be integrated with other tokens.

Token Sets have already launched an mAsset FAANG index on Ethereum and other platforms such as Nebula and Phuture are also looking into the expansion of mAsset-based tokenized financial products.

4. Capital Efficiency

Besides working on Mirror projects, plans and partnerships, Terraform Labs will also focus on improving the AMM capital efficiency. Since mAssets exhibit much less volatility as compared to most other cryptoassets, this means that traditional passive AMM liquidity would be even less capital efficient than crypto.

If Terraswap can develop their current passive AMM model into the next Uniswap v3, the resulting capital efficiency should captivate much more liquidity providers and produce deeper markets which attracts a larger pool of traders.

According to Do Kwon, Terraform plans to come up with use cases for traditional assets that “were previously super boring” and mAssets can be used flexibly for collateral, yield and leverage.

Conclusion

MIR seems to be in the best position to capture the market demand for synthetic assets on the blockchain.

Amongst LINA, SNX, and MIR, MIR possess the strongest fundamental metrics and ratios in terms of volume/mcap, mcap/tvl, web traffic, etc, making their valuation the most fairly priced at the moment.

It has strong demand so far and a good future but this can easily be challenged if other platforms such as SNX or LINA if they are able to garner more traction.

The current inflation rate of $MIR is slightly high, which could result in price stagnating for awhile until more good news and updates happen.

The popularity of delta neutral strategies on Mirror where both a long and short position is taken in order to farm the $MIR tokens may be stagnating its price as well due to the low risk nature and high APY of this farming strategy.

It will be interesting to see how Mirror protocol holds up with growing regulatory concerns.

Overall, Mirror protocol is the most widely used synthetic protocol with great features, sound mechanics. They have the potential to be the decentralized Robinhood especially as Terra forms more bridges to other networks.