The news that dYdX V4.0 will be deployed on Cosmos may have taken the community by storm, but only confirmed what the team at Switcheo Labs already knew — that Cosmos SDK is the way to go for building a fully decentralized orderbook DEX, and more importantly, a strong validation that Carbon and Demex is ahead of the pack.

- Carbon — V2.6.0 Software Upgrade, and other updates

It’s been an incredibly fulfilling period for Carbon.

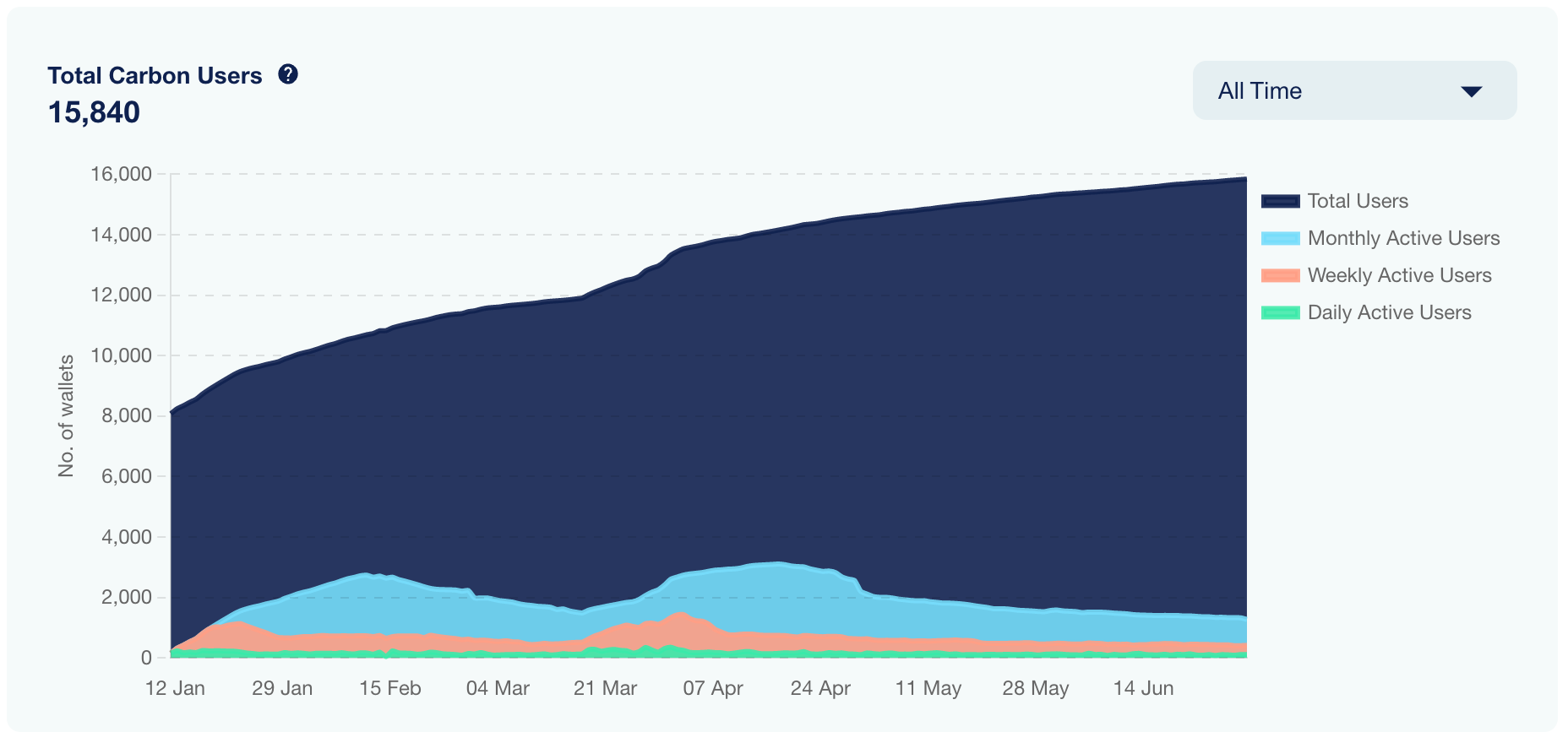

Since our last update, we’ve crossed the 15,000 mark for total Carbon users! This marks a strong, sustained growth despite the bearish downturn, a heartening sign that Carbon is not alone in its vision — to be the core of decentralized finance — but instead, marching forward with a bunch of loyal supporters behind the scenes.

For more on-chain data, head over to scan.carbon.network.

1.1. V2.6.0 Software Upgrade

Despite the market sentiment, or perhaps because of it, it has never been more urgent for projects to focus on their original vision, hunker down, build. And that’s exactly what the team at Carbon did for its latest V2.6.0 software upgrade — build.

1/⚖️ [CIP-11] The V2.6.0 upgrade is here 😉

— Carbon (@0xcarbon) June 21, 2022

Key improvements to #Carbon

🔹 Bridge module

🔹 Token import

🔹 Promoting greater participation → Slashing inactive oracles

Calling all $SWTH stakers!

📜 Proposal details https://t.co/3HwthbdtCy

🗳 Vote https://t.co/842VPHWDe5

- Bridge Module

Cross-chain interoperability is crucial to unlock the potential of digital native assets. Supercharging seamless cross-chain transfers, Carbon’s bridge module enables just anyone to bridge assets across all supported chains on Carbon in just one transaction, without requiring a Carbon account.

The team is currently hard at work in preparation for the launch of Carbon’s very first native bridge (powered by the bridge module), and expects to launch it on CarbonHub shortly - share with your community and stay updated on our socials!

- Permissionless token import

Carbon is committed to streamlining your DeFi experience. Where users had to submit a proposal through governance to list new tokens previously, the permissionless token import feature enables anyone to add their desired tokens on supported chains effortlessly on Demex in just 2 simple steps: select (1) desired blockchain and (2) token address. This gives users full control over what token is being listed, granting them unrestricted access.

- Slashing inactive oracles

To promote greater validator participation and enhance chain health, a ‘Slashing inactive oracles’ feature was rolled out in Carbon’s V2.6.0 upgrade. As of now, validators that have less than 25% voting uptime within each one hour window (spanning ~1600 blocks) will have their delegated tokens slashed at an amount of [0.0000491% * min(no. of consecutive slashes + 1, 24)]. The maximum slashing per day is approximately equal to the current inflation rate.

The slashing count will be automatically refreshed once validators pass the threshold.

In line with this, to improve transparency, validators and delegators alike can now track and monitor their slash count on Carbonscan.

1.2. Refreshing liquidity rewards and adjusting pool weights

To facilitate trading and reduce market volatility, having liquid orderbooks on Demex is of utmost importance. In line with this, Carbon has an in-built reward module in its code, enabling liquidity providers to benefit from providing liquidity to liquidity pools (LPs), earning a percentage of block rewards in addition to taker fees from trades made for that market. This is especially crucial for Carbon’s AMM-backed orderbooks which simulate AMM liquidity as real orders on Demex orderbooks.

The previous cycle of LP rewards came to an end 10 June, 2022; For the new cycle (until 2nd September, 2022), we increased LP rewards to a static 40% of block rewards. With this reward structure, liquidity providers will be able to enjoy consistent, higher APRs and are better incentivized to deposit their tokens in Demex pools with higher rewards awarded, driving higher liquidity.

By reviewing the reward curve every 12 weeks, we hope to make timely adjustments according to market sentiments and total amount of liquidity provided. This will enable users to maximize rewards earned, as the team strives to allocate liquidity rewards efficiently.

⚖️ [CIP-10] The proposal to refresh LP rewards and reallocate pool weights is now available for voting! 🗳$SWTH stakers, cast your votes here: https://t.co/1uTmo61xNF ✨ https://t.co/rFzanKWEUS

— Carbon (@0xcarbon) June 9, 2022

In line with the above, the pool weights of the following pools — XSGD/BUSD, USDC/ETH, USDC/WBTC and OSMO/BUSD — were adjusted. These pools observed lower liquidity utilization rates and by lowering their weights, we seek to allocate rewards more effectively to existing and upcoming new pools that might attract more organic volume.

For more information, click here.

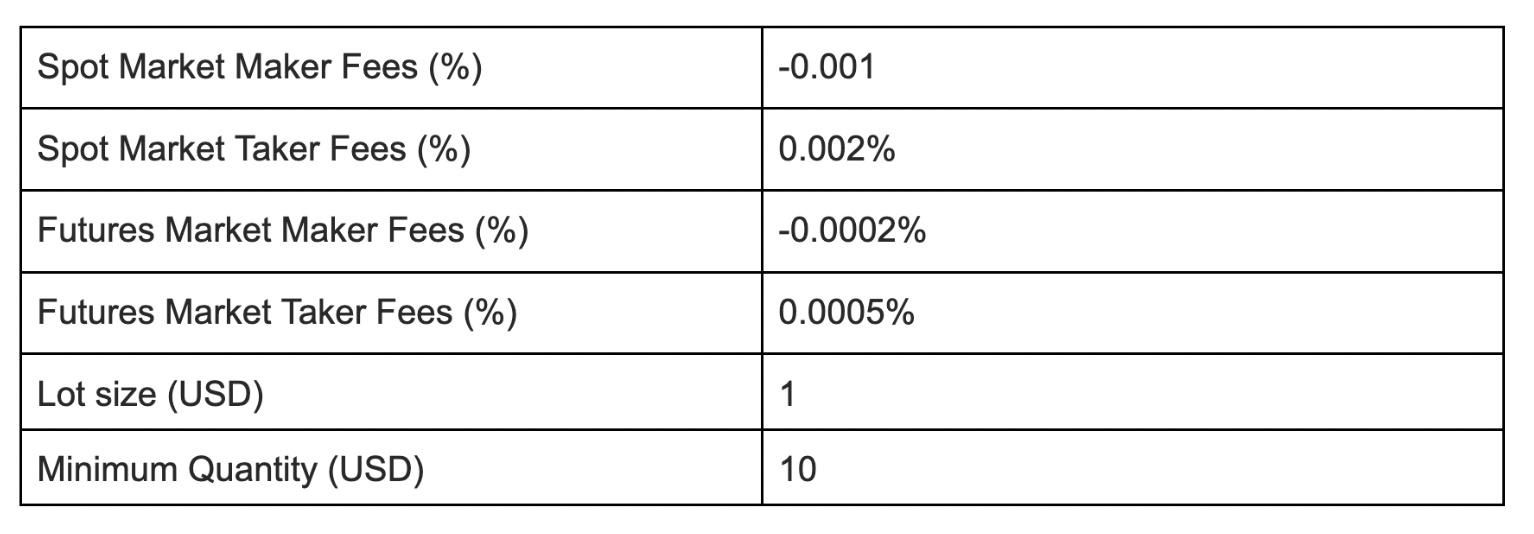

1.3. Updating default market parameters

To ensure that they are in line with existing markets and documentation, the default parameters for markets were updated —

Click here to view the proposal.

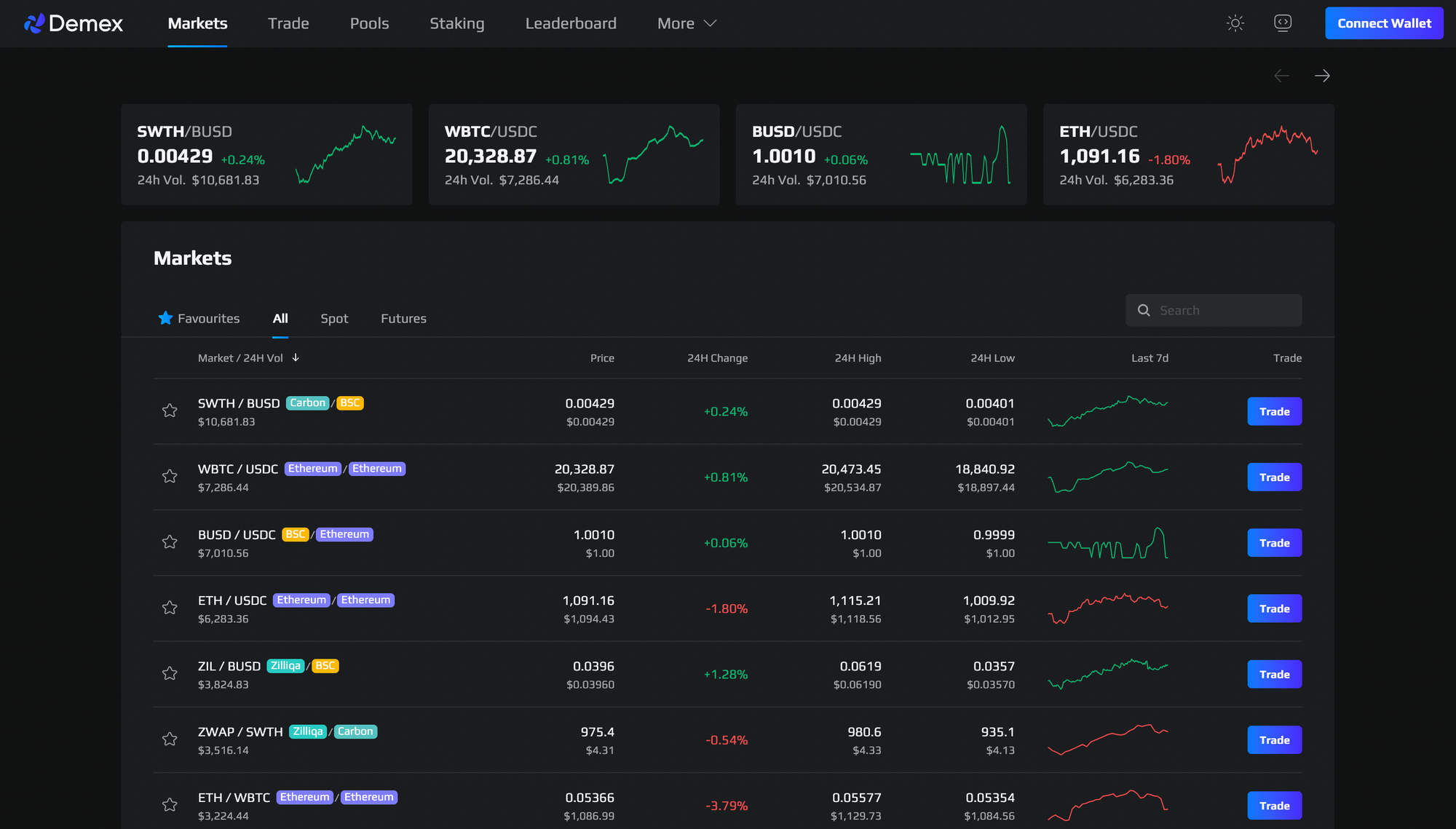

2. New market interface on Demex!

Yes, you read right — this month, we bring to you a new market interface on Demex. Built on Carbon, Demex is a fully decentralized platform that supports any cryptocurrency derivative product. Demex is highly-optimized for trading-related execution paths and provides the speed, scalability and safety you need, so you can trade the way you want.

Demex prides itself in supporting users with a seamless trading experience, and with the latest Markets UI refresh, users can now easily analyze the spot and futures market, all on one interface.

If you have not had the chance to experience the new Markets UI, now is the time!

P.S. In case you missed it, we released a Trade UI refresh last month; Check out the squeaky clean trading interface here.

3. Demex Futures Trading Competition — Maker vs Taker: Out with the old, and in with the new

We’re happy to share that the Maker vs Taker futures trading competition 1.0 has ended with a bang. The heartiest of congratulations to all winners, and to all participants, thank you for your participation!

You know what they say — Time flies when you’re having fun. Just like that, we’ve reached the end of the #MakervsTaker futures trading competition 💫

— Demex (@demexchange) June 24, 2022

A huge thank you to everyone who participated 👋🏻 pic.twitter.com/BHT7uolKi3

We will provide an update shortly on the status of the prize winnings.

At the same time, as the title of this section suggests, we're excited to announce that the next futures competition is going live TODAY, 1 July, 2022 at 8:00am UTC. Similar to the previous competition, traders can trade on the BTCUSD or ETHUSD futures markets with $USDC as collateral, at up to 50x leverage, for a chance to win from a $20,000 prize pool. Be sure to set your alarms!

Thought we'd sneak up on you, it's time for another Futures Trading Competition! 🔥🔥

— Demex (@demexchange) June 30, 2022

The competition will be live from tomorrow, 1st July - 30th September 2022 at 08:00 UTC!

Trade BTC or ETH futures to win from a $20,000 prize pool! More details coming very soon! 😏 pic.twitter.com/RsEm4A7UAJ

For more information about competition guidelines, rules and prizes, click here.

4. Zolar — Time to build your Guilds!

Over at Zolar, Zolarians everywhere are still gearing up steadily for a sweet taste of that cosmic gold.

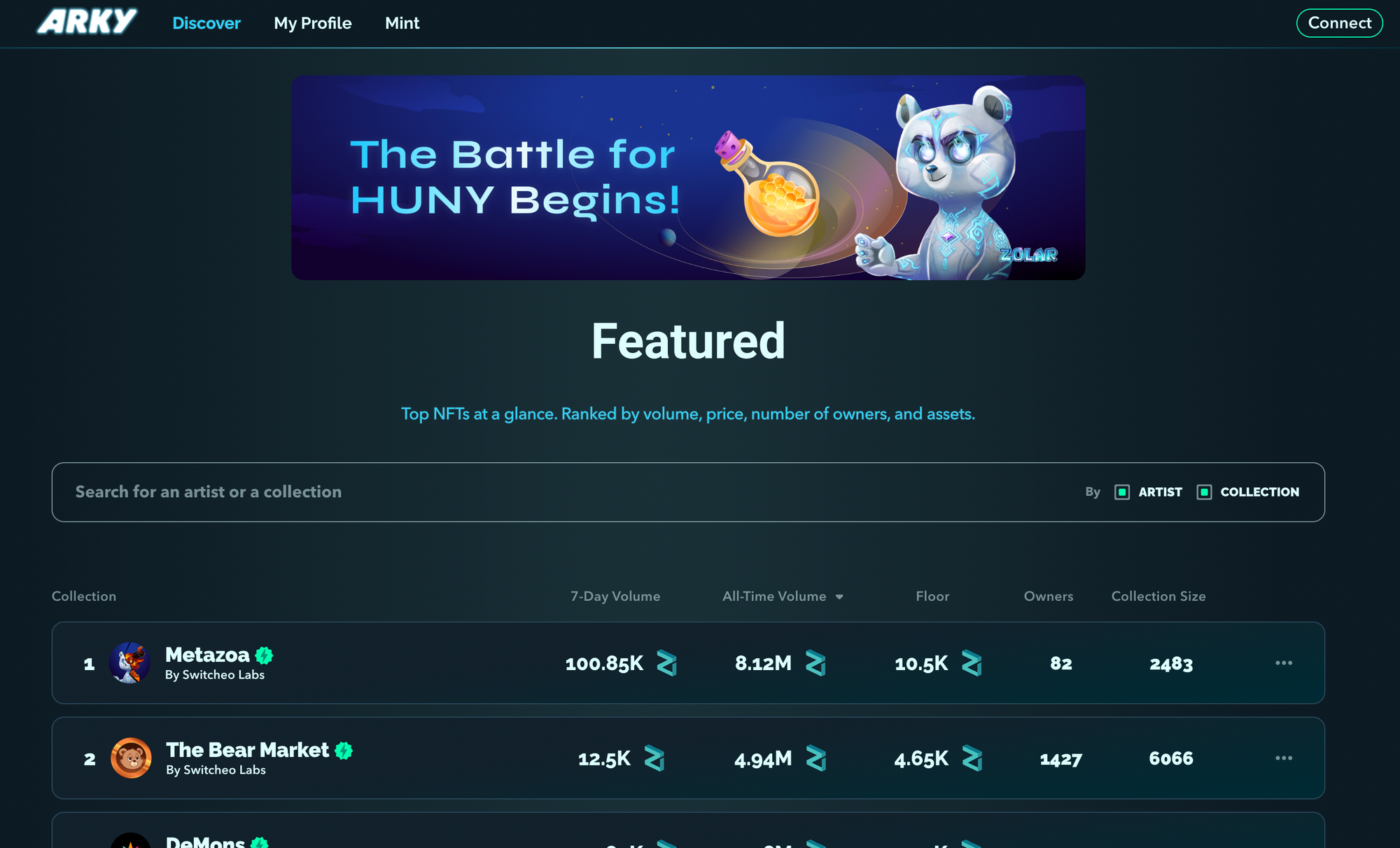

In just a month, trading volume for our Metazoa collection on Arky increased by over 1,000,000 $ZIL, reaching an all time high of 8,120,000 $ZIL, with The Bear Market collection coming in second at a striking 4,940,000 $ZIL in all-time volume.

Commanders, all Gen 1 #Metazoa have been summoned, activating the release of Gen 2 elite forces! The battle for $HUNY rages on 🔥🔥🔥

— ZOLAR (@bearmarketnft) June 11, 2022

🚀 Only 500 Gen 2 #Metazoa

🚀 18,000 $HUNY per summon

🚀 Ursas harvest up to 200% more $HUNY

🚀 https://t.co/JHc50yUlJ7#ZOLAR🔵 #ShowYourZOA pic.twitter.com/YUPBpYfyPx

Since we last spoke, all Gen 1 Metazoa has been summoned and with that, we welcomed the birth of Gen 2 Metazoa!

At the time of writing, 99% of the Gen 2 Metazoa (495 out of 500) have been minted, leaving just 5 Gen 2 Metazoa up for grabs before the Gen 3 Metazoa are unleashed — Don’t say we didn’t warn you!

Reminder: Gen 2 Metazoa has enhanced HUNY harvesting abilities and can gather 2,000 $HUNY per day, twice the daily amount of $HUNY gathered by Gen 1 Metazoa.

To summon a Gen 2 Metazoa, click here. To get on ARKY, click here.

4.1. Everything you’re dying to know about Metazoa Guilds

As the adage goes, ‘United we stand, divided we fall’. The time has come for Metazoa to assemble their troops and forge new alliances, as the battle for HUNY trudges on.

4.1.1. A TLDR on Guild Formation

Each guild starts with an initial maximum member size of 30, with guild size upgrades available in the future. From Guild Crest and Guild Rooms to Guild Officers and Champions, players are in for an adventure!

🪐 ZOLARIAN GUILD INAUGURATION 🪐

— ZOLAR (@bearmarketnft) June 13, 2022

In the bearest of markets, seek warmth and solace among like-minded comrades at your guild hearth 🔥 Band together to unlock new missions and advance your $HUNY quest for #ZOLAR🔵 dominion!

🏛️ https://t.co/ap2G8uwe0R

📜 https://t.co/yp3eXMG13B pic.twitter.com/r0flNJLO59

Not forgetting Guild Banners and Sigils too, with the latter representing the Guild’s current playstyle. Far from aesthetics, they affect upcoming drops and future gameplay mechanics, so be sure to choose wisely.

P.S. Can you spot the different playstyles and their characteristics in the poem below?

"Far over the metaverse wide and mystical,

To galaxies bright and ethereal,

We must rally and march to our common goal,

To seek the dazzling liquid gold.

For all Metazoa — Ursas and Minos,

With your piercing spears and gleaming shields, behold!

The time has come to build a guild,

A task fitting for the masterful and skilled.

Summon your guild’s magical power,

The sigil on the banner hanging from your guild’s tower.

Calling for all Merchants far and wide,

Whose vision and enterprise overcome every tide.

Ursas, beware. With the Mercenary, you’re in for a ride.

Cunning and ruthless, kidnapping and pillaging shape their very pride.

Steadfast and loyal, Guardians, will you defend our metaverse,

Safeguard our Metazoas and restore the cosmic balance?

Warriors, standby — With honour and might,

Together, Zolar shall see its first light.

The journey ahead is littered with treacherous danger.

In Zolar’s cosmic sphere of myth and mayhem, Rangers,

Your fate has been written in the stones.

Now, let’s begin the battle for the throne!"

Friendly Note: All Guilds have to be inaugurated with a bespoked Guild Crest. The price of a Guild Crest scales with the circulating supply of $HUNY, so be sure to form your guild earlier, rather than later!

4.1.2. Ready Player One: HUNY Power and Strength Rating

The prestige bestowed on each Guild depends on “Strength rating” and “HUNY power”, which confer esteemed benefits respectively. Strength Rating is a measure of the Guild's combined strength and will be used for various airdrops and Missions in the future.

Zolarians, the time has come to build your Strength in guilds and lay the foundations of #ZOLAR🔵! To gain ultimate Strength is to achieve mastery over all the cosmic forces that power the Zolarverse. pic.twitter.com/IqcURBYpq6

— ZOLAR (@bearmarketnft) June 22, 2022

Who you’re battling side by side with determines how far you’ll go in the Zolar multiverse; Choose your Guild members with careful deliberation!

For more information, teleport here. To join or create a Guild, click here.

4.2. Ended: Operation Sticky Paws

Calling all agents — Your hardwork and bravery has paid off and Operation Sticky Paws was a success! Two combatants have emerged victorious from the battlefields and proved themselves to be epitome of willpower and perseverance.

Congratulations to our 🐾 CODENAME: STICKY PAWS 🐾 agents who have successfully completed the operation! Your new #Metazoa have been deployed and await your command 🫡🪂

— ZOLAR (@bearmarketnft) June 21, 2022

Send them to battle and advance your $HUNY conquest!

✨ https://t.co/CfdDYe3a1f ✨#ZOLAR🔵 #PoweredbyZIL pic.twitter.com/4ARaR2NAWV

As promised, the Metazoa rewards have been deployed. Until the next mission, lads!

5. Switcheo Research

Bear markets might come off as a taboo word to some in the Web 3.0 space, but on the flip side, for others, this period is also championed as the opportune timing to double down on building their strength for the next bull run, but the daunting question lingers, unspoken: Will they make it? Switcheo Research digs in so you don’t have to.