Band Protocol is a cross-chain data oracle platform that aggregates and connects real-world data and APIs to smart contracts on various blockchains.

Context

Although most smart contract platforms are great at immutable storage and verifiable transactions, they lack access to real-world data. This limits the potential of the applications that are developed on these platforms, especially when we think about just how many of the products and tools we use today rely on these real-world data.

Oracles transmit real-world data (off-chain data) to dApps and smart contracts that live on blockchains (on-chain data).

An example is Mirror Protocol, an investment dApp on the Terra blockchain that lists synthetic equities which requires the data of real-world stock prices in order to work properly. Mirror requires oracles to get data from the real-world prices to be referenced in their dApp.

You can read the Switcheo Research article on Mirror Protocol here.

Oracles can bring all sorts of data onto the blockchain, from asset prices, weather conditions, event outcomes, to proof of payments. They have become a key infrastructure to the crypto world as the growth of decentralized finance (DeFi) is normally measured in the total value locked (TVL) in these blockchains.

DeFi’s TVL has grown over 500x in less than 3 years, with just $273 million locked up at the start of 2019, to $150 billion as of August 2021. The amount of TVL also corresponds to the amount that is being secured by oracles as more and more dapps require data from the real-world and on the blockchain. We foresee that the demand for data feed will only increase as DeFi continues to grow and more assets get tokenized.

Hence, for DeFi to succeed, dApps needs to be able to secure large amounts of funds safely by referencing all kinds of data safely and reliably, and this is done with the help of oracles.

The Problem: Centralized Oracles

Although there have been efforts put in to address these issues, majority of the solutions still experience at least one of the following problems:

- Centralization

- Network Congestion

- High Cost

Illustration of the problem before cheap, fast, and decentralized oracles were created:

Centralized oracles are controlled by a single entity and act as the sole provider of data for a smart contract. They require contract participants to place a significant amount of trust in one entity. They also represent a single point of failure which threatens the security of a smart contract.

If an oracle is compromised, so is the smart contract. The accuracy and effectiveness of smart contracts rely heavily on the quality of data they are provided with — and thus oracles retain a significant amount of power over smart contracts.

The whole reason that smart contracts were invented was to avoid counterparty risk and an over-reliance on third parties. Oracles enable contracts to be executed between trustless parties, but can risk becoming the middlemen they sought to replace (especially when they become over-centralized).

Known as the oracle problem, the preservation of privacy, security, and fairness — and the avoidance of over-centralization that could damage the relationship between smart contracts and blockchains — then becomes the key challenge that oracles face.

The Solution: Decentralized Oracles

Decentralized oracles aim to achieve trustlessness and predictable results that rely on cause-and-effect, rather than on individual relationships. These results are achieved by distributing trust among many network participants, the same philosophy as that blockchains encompass.

By utilizing various data sources and using an oracle solution that isn’t controlled by a single party, decentralized oracle networks can provide better security and fairness to smart contracts.

Decentralized oracles’ potential to solve the oracle problem would greatly expand the use cases of smart contracts across many different markets for the blockchain industry.

Introduction to Band Protocol

Band Protocol is the 2nd largest decentralized oracle solution, after Chainlink. Both protocols were founded in 2017 although Band only launched version 1.0 in September 2019, giving Chainlink a huge head start.

It is built on top of BandChain, a high-performance public blockchain that enables anyone to submit a request for APIs and services available on the traditional web.

BandChain itself was developed on top of the Cosmos SDK, and utilizes Tendermint's Byzantine Fault Tolerance consensus algorithm to reach immediate finality. This finality is specifically reached upon getting confirmations from a sufficient number of block validators.

Product Analysis

The flow of requesting data from BandChain can be broken down into four main steps:

- Publishing the necessary data sources and oracle scripts to the network

- Sending the oracle data request transaction

- Fetching the necessary data

- Aggregating and storing the request result onto BandChain

A data source is the most fundamental unit in BandChain's oracle system. It represents the process to retrieve a ray data point from a primary source and the associated fee with one data query. On BandChain, anyone can register a data source into the system.

Oracle Scripts

When one requests data from BandChain, they are not interacting with the data sources. Instead, they are calling one of the available oracle scripts. An oracle script is an executable program that encodes:

- The set of raw data requests to the data sources it needs

- The way to aggregate raw data reports into the final result

Oracle scripts are also Turing-complete and can be programmed in multiple languages. This composability and Turing-completeness makes oracle scripts very similar to smart contracts.

Network Participants

BandChain's network consists of a number of network participants, each owning $BAND. In the Laozi mainnet, these participants can be broken down into three main groups:

- Validators

- Delegators

- Data Providers

Lite Client Protocol

The lite client protocol helps users to verify the validity of the result they received.

It checks for 3 conditions:

- that the proof received in the request can be used to construct a valid block header

- that using the constructed block header, it can recover a valid set of validator addresses who signed on the block

- that those validators have sufficient total voting power relative to the system total

The diagram below illustrates the above steps:

Cosmos IBC Integration

In addition to Band’s very own lite client protocol, they also allow interaction with their data oracle through Cosmos' Inter-Blockchain-Communication, or IBC, protocol.

IBC allows for cosmos dApps to transfer tokens and data to each other, meaning that blockchains with different applications and validator sets are interoperable, essentially able to talk to one another. This would be a huge plus point for the protocol because the Cosmos IBC Integration would allow other IBC-compatible blockchains to request data from BandChain.

Being cross-chain compatible and operating on an independent blockchain prepares BandChain to serve as a key player in the ever-growing cross-chain and multi-chain narratives.

Tokenomics

Band Token and Use Cases

$BAND is currently utilized as the sole native token of BandChain. The chain then uses the promise of receiving reward tokens as an incentive for validators to produce new blocks and submit responses to data requests. Additionally, all participants of the network can use the tokens in the following ways:

- Bond tokens to become validators

- Delegate tokens to another validator to earn a portion of the collected fees and inflationary rewards

- Participate in the chain’s governance

The random subset of validators is randomly selected based on the voting power of validators. Similar to the Proof-of-Stake (PoS) concept, validators with higher voting powers are those who have staked more $BAND. Since they are exposed to higher levels of risks, they will be incentivized to be good actors and deliver the correct oracle results within the expected timeframe.

Conversely, the ones who have lower voting power are exposed to lesser risk which means they will generally be less incentivized to perform. Instead, they can become a delegator by delegating their stake to a validator of their choosing. Delegators in turn receive block rewards proportional to their delegated contribution of BAND relative to the total amount of BAND the validator has staked. Essentially, users who stake BAND earn both newly minted tokens from the protocol as well as fees from applications that use its service.

Token Supply

The token supply distribution is as follows:

- Seed Sale Investors comprise 10.00% of the total token supply.

- Private Sale Investors comprise 5.00% of the total token supply.

- Public Sale Investors comprise 12.37% of the total token supply.

- Ecosystem comprises 25.63% of the total token supply.

- Team comprises 20% of the total token supply.

- Advisors comprise 5.00% of the total token supply.

- Foundation comprises 22.00% of the total token supply.

The total supply of BAND is 100 million though this is expected to change in the future (more on this later). 27.37% of all BAND tokens were sold between the 2 ICO and IEO rounds.

We can see that public sale investors only consist of 12.37% of the total $BAND supply. Having more tokens allocated to private investors is not really good news as this would mean more tokens would be locked up. This ultimately results in less token liquidity, as the token release usually takes a long period of time. This could be the reason why the $BAND token remains at a relatively low price.

$BAND vs $LINK comparison

Currently, $BAND has a circulating supply of 35,191,821 while $LINK has a circulating supply of 450,509,553.

$BAND has a maximum supply of 100,000,000 while $LINK has a maximum supply of 1,000,000,000.

Chainlink Token Supply:

Compared to $BAND, 35% of the $LINK went to incentivizing node operators. The other 35% were sold in the pre-sale and public sale. The company reserves the remaining 30% of $LINK. They are kept to compensate the project developers and staff. That leaves 350,000,000 LINK in circulation.

This once again shows that there might be too low a percentage of $BAND allocated to public token sales.

Token Inflation

An inflationary model is applied on $BAND to incentivize network participation by the token holders. The aim of such a model is to motivate token holders to stake their coins on the network, instead of purely focusing on trading, or doing nothing with it at all.

For instance, if token holders choose not to utilize their coins to participate in the network’s activities, the percentage of their holding with respect to the total supply will decrease over time. On the other hand, if they decide to stake their coins, they will be given a share of coins proportional to the inflation, which means that their total token holding ratio will now remain relatively unchanged.

The specific inflation parameters currently mirror that of the Cosmos network; namely, the annual inflation rate ranges from 7% to 20%, and is adjusted to have 66% of the total supply of $BAND staked. 98% of all inflationary tokens are awarded to stakers. 50% of all BandChain transaction fees are burned.

It is estimated that all 100,000,000 supply of $BAND will be fully diluted by August 2024.

Roadmap

According to BandChain’s recently unveiled roadmap, there is much more to anticipate from them. A complete list of the latest roadmap can be found here.

As of now, they have fulfilled the following milestones on time:

✅ Public Testnet Release

✅ Release of Mainnet phase 0

✅ CosmoScan release

✅ 17 genesis validators bootstrapping BandChain

✅ Mainnet genesis ceremony

✅ Strengthening Band Oracle Infrastructure for Layer-1 and Layer-2

✅ Release of Phase 1 Testnet #1

✅ Integrating Testnet DApps and partners to Mainnet

✅ Implementing bridges to multiple blockchains

✅ Developing On-chain Verifiable Random Function

Exciting upcoming milestones for the rest of year 2021 includes:

🔜 Q4 2021: Phase 2 mainnet migration

🔜 Q4 2021: Cosmos IBC compatibility

🔜 Q4 2021: Secure key partnerships

🔜 Q4 2021: Begin to decentralize the maintenance of documentation and developer guides

Fundamental Analysis

Market Stats

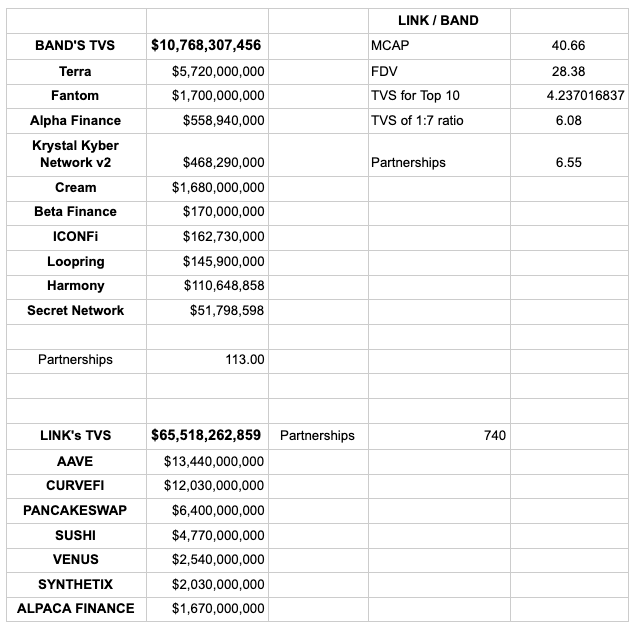

Current MCAP and FDV of Band Protocol and Chainlink

Band Protocol : MCAP - $320,412,764, FDV - $912,880,021

Chainlink : MCAP - $13,026,842,984, FDV - $26,293,311,300

Although Chainlink has the first movers advantage, Band Protocol has the opportunity to learn and adapt from Chainlink’s shortcomings.

As of now, Chainlink’s market cap is 40x of Band Protocol. ETH gas and network congestion remains to be a problem, the market is potentially undervaluing Band Protocol.

Total value secured

Currently, we are unable to find some comparison figures between $BAND and $LINK, particularly their TVL, daily transactions, total transactions, active validators, etc.

Thus, we have come up with some assumptions to perform an imperfect analysis on the rough total value that each protocol is securing via its price feeds to extrapolate the relative valuations between $LINK and $BAND. This is done by using the total value secured as the metric for comparison.

The following assumptions have been made:

- The TVS (total value secured) of an oracle protocol should be directly correlated to the value and market cap of the oracle protocol.

- TVS (total value secured) = TVL (total value locked). This is not always a correct assumption as certain protocols have their own protocol tokens under TVL which may skew the TVL that we are interested in.

- The TVL taken from DefiLlama is accurate.

- Taking the ratios for their partnerships instead of the full amount. There is a vast difference in the number of partnerships between LINK and BAND. We tried 2 main comparisons, between the top 10, and taking the ratio of the partnership i.e. top 5 from BAND and top 35 from LINK so that the ratio remains around 1:7.

From the above, we can see that although $LINK is 40x more expensive than $BAND, $LINK secures around 6x more value than $BAND. This means $BAND is potentially undervalued if comparing MCAP and TVS as the only metric we use for valuation.

However there are other metrics such as number of oracle requests that we are unable to find, hence the valuation is incomplete.

Competitor Analysis:

Apart from Link, other competitors of BandChain include: Charli3 (C3), API3 and WinkLink.

C3 is an open source decentralized oracle to the Cardano Network. It helps to provide and verify data (initially focused on blockchain economic values) for blockchain applications.

API3 is a platform for decentralized API services targeted at the web3 infrastructure. Data feeds are served and governed in a decentralized manner and data will be distributed across different providers and will also be accessible by smart contracts.

WinkLink uses its smart contracts to connect data from the real world, and ensures data reliability through a decentralized mechanism. It is also the first TRON ecosystem comprehensive oracle.

Recently, there has been another decentralized, cross-chain data oracle built on the Solana blockchain called Pyth network. It went live on August 26 and will mainly focus on offering market data from trading firms and exchanges. Solana has hit an all-time high and quickly entered the list of top 10 cryptos based on market cap. Having an decentralized, cross-chain data oracle built on the growingly popular blockchain would definitely pose a huge threat to BandChain.

Opportunity

What makes Band different from others?

BandChain Oracle solution serves as a middle layer operating between the smart contracts platforms or decentralized applications and the various data providers.

The oracles' task includes:

- Handling data requests coming from the dApps

- Querying the data from the corresponding providers, and

- Reporting the results back to the application.

Bandchain Oracle differentiates itself from other oracle solutions in four main ways:

- Decentralization: Decentralized through the introduction of maximum redundancy on two separate layers in the infrastructure design: BandChain validators (consensus level) and data source level

- Flexibility: Allow maximum customization and flexibility for user to query and compute their desired data feed

- Scalability: Specifically designed for oracle data request and computation.

- An average block time of only 3 seconds.

- Ability to offload all the heavy oracle computations from the requester’s chain and onto BandChain, which have been specifically optimized for these sorts of computations.

4. Cost: Pay the associated fees on a per-request basis.

The biggest advantage of Band compared to other oracle solutions is that it has its own blockchain utilizing the Cosmos-SDK, whereas any other solution from Chainlink to Tellor are just Ethereum dApps and tokens.

This offers more possibilities from a security standpoint as well as flexibility that is needed to provide custom oracle solutions; Moonbeam, Equilibrium, Cronos and Polka Cover utilizes Band Protocol to create custom oracle scripts to suit each of their individual needs.

Comparison: Band Protocol and Chainlink

Recognizing the need for reliable data inputs and outputs for smart contracts, Chainlink was the first major oracle network to launch. It’s also by far the most widely used oracle platform, with Chainlink oracles now being used by hundreds of projects such as AAVE, and Synthetix.

A major difference between the Chainlink and Band Protocol is that Link is built on the Ethereum blockchain, whereas Band Protocol was originally based on Ethereum, but moved to Cosmos. Cosmos helps Band Protocol keep costs down when sending or receiving data.

With the upcoming Phase 2 upgrade, data providers can opt to receive payment directly on-chain from developers using their services on BandChain. The upgrade also allows for cross-chain oracle requests through the Inter-Blockchain Communication (IBC) standard.

This further differentiates BandChain Oracle from other oracle solutions; Costs.

How Chainlink works

Dapp’s smart contracts communicate with Link’s Oracle to request external data. ETH is paid by the Dapp, which is then converted to LINK to be used to pay its nodes for retrieving requested external data. This process creates a bottleneck; conversion of ETH to link during high network congestion, thus making it expensive. More importantly, increasing the time it takes to retrieve external data, compromising its reliability as dapps are reliant on live data to execute its smart contract, especially during periods of high network congestion.

In addition, the nodes that data are retrieved from, are off-chain. Working outside of the blockchain is inefficient and requires two transactions to occur in order to relay the external data needed by the Dapp.

How Band Protocol works

Dapp’s smart contracts communicate with Band’s Oracle to request external data. ETH is paid by the Dapp that is then converted to BAND. This conversion happens on Band’s Cosmos infrastructure. Cosmos eliminates the dependence of the ETH blockchain which is subject to network congestion and high gas fees.

In addition, Band’s Oracle communicates with its network nodes that live on-chain, providing seamless relay of information and it does not require two transactions to occur unlike Chainlink.

To summarize, Band Protocol was built with Chainlink’s shortcomings in mind. With Band Protocol being based on Cosmos, it got around some of the scalability issues that Chainlink are experiencing; congestion on the Ethereum network causing Chainlink oracles to stop working at various high traffic times.

Target Audience

Band protocol’s targience audience is essentially all the Dapps.

Community

BandChain:

Telegram - 10,512 members

Twitter - 103,600 followers

Discord - 3,561 members

Chainlink:

Telegram - 37,823 members

Twitter - 445,500 followers

Discord - 21,478 members

We can see that the band protocol community is relatively strong. Currently, the protocol has got plenty of user generated content (UGC) from the community who are willing to commit their time to provide their opinions and share their analysis. This ultimately would help BandChain in enhancing their brand recognition.

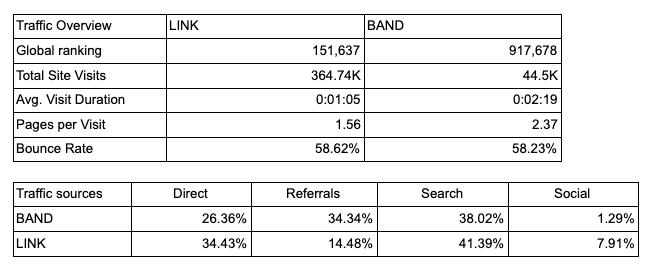

Traffic

Link: https://www.similarweb.com/website/bandprotocol.com/?competitors=chain.link

Team

Soravis Srinawakoon is the CEO and co-founder. He has been featured in Forbes 30 under 30. He was previously a management consultant with a strong technical background in computer science.

Sorawit Suriyakarn is the CTO and co-founder. He has an M.Eng. /S.B. in EECS from the Massachusetts Institute of Technology with previous gigs at Hudson River Trading, Quora, and Dropbox. He can write all sorts of programs ranging from formal verification (Coq), “smart contracts”, HFT low-level high performance, backend shenanigans, and sometimes frontend.

Paul Nattapatsiri is the CPO and a co-founder. He has created several crypto gaming apps with over 800,000 users. He has worked with Tripadvisor and Turfmappx.

Other members are Bun Uthaitirat who is the Chief Fun Officer and Developer, Atchanata Klunrit at the Operation and legal office, Kanisorn Thongprapaisaeng and Prin Rangsiruji who are developers.

Technical Analysis

$BAND has potentially made a bottom as it bounced off $4, which is the 0.382 fibonacci retracement on the log scale, a popular level for fundamentally strong altcoins to bottom at.

It is also in a slightly upwards parallel channel, indicating a bullish macro structure.

In terms of weekly RSI, it has yet to break out of the downwards trendline. It would be best to buy after it has broken out.

In terms of risk reward ratio, assuming the 0.382 fib retracement is the market structure support and the 0.5 fib extension and the top of the mayer multiplier band is the market structure top, there’s a risk reward ratio of 8 which is acceptable.

Risks

A potential risk of BandChain would be their reliance on randomness. A core component of the protocol, randomness is a requirement when it comes to the choosing of oracle nodes although this feature is not being supported by any original academic research. As a result, this severely limits data accessibility as every node must have access to the same data and network security (having to trust every node).

In comparison, Chainlink does not include randomness as a core part of their protocol, which exposes users to greater flexibility and quality control mechanisms when it comes to choosing nodes and connecting to data. They established the Chainlink Verifiable Randomness Function (VRF) as a new approach to create a provably fair on-chain source of randomness for things like blockchain gaming and NFT Dapps, all have been supported by leading and original academic research.

BandChain was also involved in a scandal where they were accused of trying to copy Chainlink VRF on their Github repo:

However, this should not be too big of a problem as we would consider this all a part of composability, where existing resources can be used as building blocks and programmed into higher order applications. Composability is crucial because it allows developers to do more with less, which could in turn lead to more rapid and compounding innovation:

Conclusion

The IBC Pump

Highly speculative and unsubstantiated, but if the IBC narrative starts to get popular from LUNA’s Columbus-5 upgrade, it could potentially pump the entire cosmos system which includes $BAND.

$BAND is upgrading to IBC in phase 2 as well.

Band Phase 2 Pump

Lots of big upgrades coming to Band protocol, from on-chain revenue stream, verifiable random function, and a lot of enterprise partnerships.

Risk reward

In terms of risk reward ratio, assuming the 0.382 fib retracement is the market structure support and the 0.5 fib extension and the top of the mayer multiplier band is the market structure top, there’s a risk reward ratio of 8.

Potentially undervalued based on total value secured

$BAND technology is on par and after Band Phase 2 which releases this year, it could potentially be better than $LINK. However due to the immense headstart that $LINK has, $LINK has been the go to solution for most top defi protocols, allowing $LINK to be valued at 40x more than $BAND in terms of market cap.

After performing dubious and probably flawed analysis on the rough total value that each protocol is securing via its price feeds to extrapolate the relative valuations between $LINK and $BAND, we can see that although $LINK is 40x more expensive than $BAND, $LINK secures less than 10x more value than $BAND. This means it can be potentially undervalued if TVS was the only metric.

Overall, both protocols, $LINK and $BAND are critical to DeFi and due to the importance of decentralized oracle solutions, it is paramount that there is more than one oracle solution at all times. In terms of potential financial returns, $BAND appears to be the better choice due to the currently high valuation of $LINK.